|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Discover the Best Online Mortgage Calculator for Your NeedsWhen planning to buy a home, understanding how much you can afford is crucial. A mortgage calculator is an essential tool that can help you figure out your monthly payments, interest rates, and other financial details. In this article, we'll explore the best online mortgage calculators available today. Why Use an Online Mortgage Calculator?Online mortgage calculators are user-friendly tools that provide quick insights into your potential mortgage payments. They help you make informed decisions by allowing you to input different variables such as loan amount, interest rate, and loan term. Benefits of Using a Mortgage Calculator

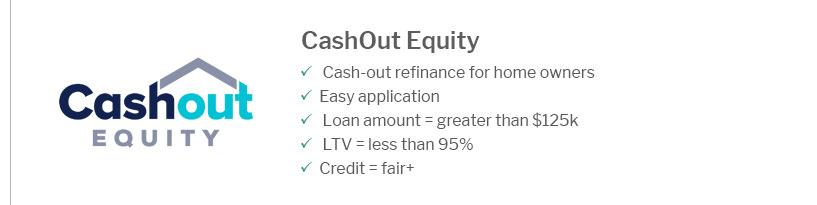

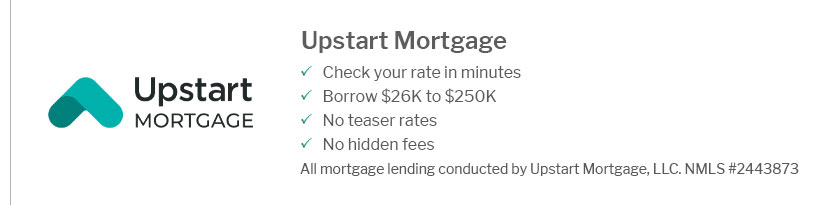

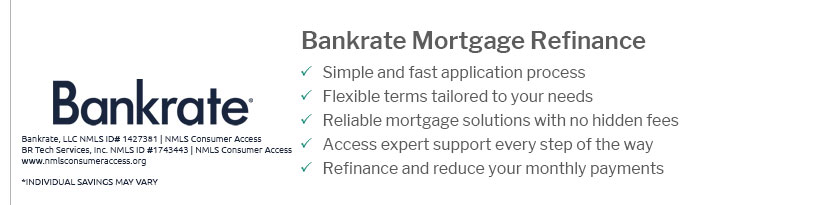

Features to Look for in the Best Mortgage CalculatorsWhen choosing the best online mortgage calculator, consider the following features: User-Friendly InterfaceA simple and intuitive interface ensures that you can easily input your data and understand the results. Comprehensive CalculationsThe best calculators provide detailed breakdowns of monthly payments, including principal, interest, taxes, and insurance. Advanced OptionsLook for calculators that offer advanced options, such as the ability to factor in extra payments or adjust for different interest rate scenarios. You might also want to explore a compare my mortgage tool to evaluate different offers side by side. Top Picks for Online Mortgage Calculators

FAQ

https://www.nerdwallet.com/mortgages/mortgage-calculator

This mortgage calculator lets you change the loan amount, interest rate, loan term and other factors so you can see the effect on monthly payments. Feel free to ... https://www.zillow.com/mortgage-calculator/

Use Zillow's home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, ... https://www.bankrate.com/mortgages/mortgage-calculator/

Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use ...

|

|---|